INVESTMENT THESIS

Although Akzo Nobel has dipped into a variety of chemicals markets, the company is primarily a coatings producer. In fact, until the recent divestiture of its North American coatings business, Akzo was the world's largest paint and coatings company. Recently, Akzo has struggled because of less than ideal end-market and geographic exposure. As a paint-producer, the firm is heavily leveraged to the housing and construction market--roughly 45% of company revenue. Suffice it to say, this market has hit a rough patch over the past few years, limiting Akzo's ability to grow. Further, Akzo's heavy exposure to Europe has dented the firm's growth and will likely continue to do so for at least the medium term, as the European recovery has been slow.

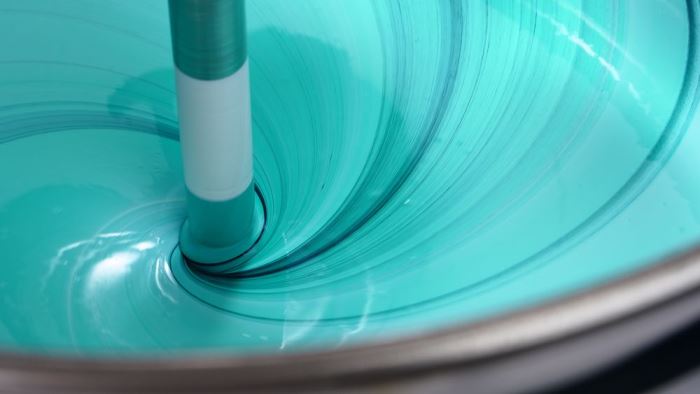

Akzo's coatings business is split between house paint and performance coatings. The firm owns a solid portfolio of decorative paints, including the well-known Dulux brand, but competition and low switching costs contribute to a tough market. In 2013, it completed the sale of its North American decorative paints business to PPG at a reasonable price, but the transaction leaves Akzo more leveraged to Europe, where a recovery in construction markets will take some time. Akzo has responded by restructuring to reflect the difficult market realities. This program has been extensive and is beginning to bear fruit, in our opinion. Despite tough market conditions we think the firm's results in decorative paints are set to improve, as the firm rightsizes its business and capacity utilization improves.

In addition to house paint, Akzo has a large presence in more specialized coatings, that is, for jets, tankers, soda cans, and so on. We take a more favorable view of these markets as customer relationships are much tighter, in some cases creating meaningful switching costs. The company also has a sizable chemicals business. Despite its "Specialty Chemicals" moniker, we view this business as a mix of both specialty and commodity chemicals, some with competitive advantages and some without. The majority of the firm's chemicals revenue comes from industrial end markets, with consumer goods and transportation also significant contributors.

WAARDERING

| Economic Moat | Fair value | Stewardship Rating |  |

||||

| None | EUR 51.00 | Standard | |||||

| Moat Trend | Uncertainty | Sector | |||||

| Stable | High |

Industrie - chemie |

|||||

BULLS

- The company has responded to tough market conditions by ramping up restructuring and cost-cutting efforts. Once finished, the cuts should set up Akzo for improved profitability.

- AkzoNobel has focused on its leading brands in decorative paint, namely the Dulux brand. Strong brands give paint producers more room to raise prices.

- Despite difficulties in its home continent, Akzo has continued to invest in emerging economies, particularly in Asia Pacific, setting the company up for growth down the road.

BEARS

- With almost two thirds of decorative paint sales generated in Europe, Akzo is highly exposed to what will likely be a very weak European construction market for years to come.

- The company has taken sizable impairment charges from the acquisition of ICI.

- Akzo can struggle to pass on raw material price hikes onto customers. The firm is exposed to hydrocarbon, titanium dioxide, and other raw material price swings.

__________________________________________________________________

Overzicht alle aandelenanalyses >

20 Tips voor het beleggen in aandelen >

Meer weten over de methodologie achter Morningstar's beoordeling en waardering van ondernemingen en aandelen?

Hoe Morningstar aandelen onderzoekt en waardeert

Morningstar's sterrenrating voor aandelen

Vragen en antwoorden bij Morningstar's aandelenonderzoek

Het uitgebreide researchrapport van dit aandeel is beschikbaar voor institutionele beleggers, vermogensbeheerders en private bankers. Voor meer informatie over de ruim 1500 wereldwijde aandelen- en creditresearchrapporten kunt u contact opnemen met Morningstar via equitysales@morningstar.com.