The risks that accompany the transition to a low-carbon economy are for example changes in regulation, technology, and consumer behavior. There are also physical risks, to be found in the vulnerability of supply chain and operations of companies, and the expected increasing frequency of extreme weather events such as flooding or hurricanes.

At the same time, more and more investors are seeking to capitalize on opportunities arising from the transition. Those include investments in companies that develop innovative solutions to mitigate climate change, such as clean energy, electric vehicles, and carbon capture and storage.

The fund industry is responding to these developments and the increasing demand from investors by launching new funds with climate-related mandates and repurposing old strategies. Morningstar data show that there were a record 1.206 mutual funds and exchange-traded funds globally with a climate-related mandate and the end of 2022, up from about 950 at the end of the previous year. The universe of climate funds consists of a wide range of strategies that connect to different preferences from investors, and that range is growing wider, as is the group of investors that is climate-conscious when it comes to their investment portfolios.

The opportunities of sustainable investing in all its aspects will be addressed at Morningstar Sustainable Investing Summit on 11-12 October 2023 in Amsterdam where a range of sustainability experts from Morningstar, fund companies, regulators and financial institutions will present everything you want to know. You can register here:

Morningstar's tools

More choice means more work for investors to compose their investment portfolios, but Morningstar can help investors in making their investment decisions with a set of tools that rate and rank investments not only by financial return, but also by sustainability impact.

Morningstar offers the Morningstar Sustainability Rating which rates funds by measuring the sustainability level of the individual portfolio positions. For the more professional audience, there is the Morningstar Commitment Level which shows fund companies’ dedication to sustainability as measured by how large the role of ESG factors is in a fund’s strategy, from acknowledgement to an integral part of it.

Spectacular growth

Morningstar fund flow data show that investors are keen to put their money into sustainable funds. If we zoom in on climate funds, we see a spectacular growth in the past years, with assets under management in Europe growing six-fold from 2018 to 2022.

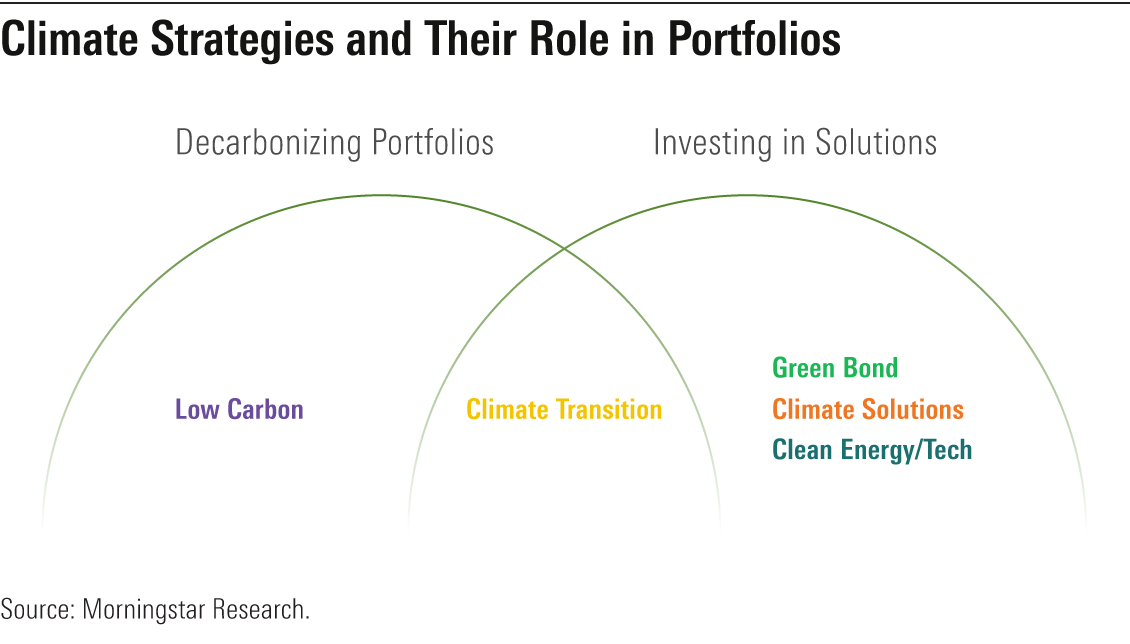

To the background of this growth, Morningstar has developed a framework for rating climate funds, breaking them down into 5 categories, each focusing on a specific area of climate impact, as the image below shows:

In the current year 2023, investors appear to have become more cautious, as the asset flows into climate funds have slowed down, a trend that started in the course of 2022. Rising interest rates, high inflation and the global economic slowdown let investors hit the brakes somewhat.

But 2023 may at the same time be the start of new opportunities, especially in the United States, where the Biden-government installed the Inflation Reduction Act per August 2022. This landmark climate legislation will boost the investments in clean energy and low carbon technologies, creating opportunities for companies to get new business and also for the investment industry.

:quality(80)/cloudfront-us-east-1.images.arcpublishing.com/morningstar/6BCTH5O2DVGYHBA4UDPCFNXA7M.png)